.png?t=1521755708284&width=1024&name=Tourism%20statistics%20for%2020172F18%20(6).png)

Our travel trends content is a staple part of what we produce at TrekkSoft, from our annual trend reportsto our blog content. Through it, we want to help tour operators and destinations to better understand what's shaping the industry – and help them to respond in the best way possible.

One year on from our 70 travel and tourism statistics to know about in 2016, we wanted to freshen things up. So here you go, a selection of our own data insights plus the research we've been talking about most here at TrekkSoft HQ.

These should help you make the most of 2017, prepare for 2018 and – we hope – get you excited for our 2018 Travel Trends Report which you can download now:

1. Leisure travellers put thought into big trips, but still enjoy spontaneity

- 55% of leisure travellers take just 1-2 vacations a year, and they put a lot of thought into planning these trips. (Google/Phocuswright, 2016)

- However, when presented with a promotion offer, 30% would take a trip when they weren't planning to. 25% would consider going to a destination they weren't familiar with. (Google/Phocuswright, 2016)

2. Rising travel research on mobile comes at no surprise

- 70% of travellers with smartphones have done travel research on their smartphone. (Google, 2016)

- 1 in 2 traveller journeys start on mobile (Booking.com, 2016)

- 50% of millennial travellers have discovered a new travel company while researching on mobile. (Google, 2016)

- 30% of mobile searches are related to a location. (Google, 2016)

- 50% of search queries are four words or longer. (Ko Marketing, 2016)

Key takeaways: It's vital that tourism websites are mobile-optimised, especially if you're a destination or tour operator selling bookable experiences. To reach your target audience while they're using their devices in-destination, mobile can also be a great place to target your digital ad spend.

For SEO benefits when creating your website content, think in terms of phrases or questions your customers might be asking, not just keywords.

3. We want to book whenever it suits us

- Tour and activity websites are most commonly visited during the evening, with Monday and Sunday evenings having the most visits. (TrekkSoft data, 2017)

- 59% of travellers begin researching their next trip between one and three months before departure (TripAdvisor, 2016).

- 38% of bookings are happening same day or up to two days before the activity. Many of these bookings take place “in-destination”, while consumers are already travelling. That number grows to 53% when looking at bookings within a week, while only 19% of these activities were booked more than a month in advance. (Phocuswright, 2017).

Our take: Consumers want flexibility in when they choose to book, whether it's advance or last-minute. Tourism providers need to provide options that allow for both planning and spontaneity. For that, you need an online booking system that updates in real-time – and no restrictions on when bookings can be accepted.

4. More consumers are staying on mobile to book instead of device switching

- After researching on their smartphone, 79% of mobile travelers in 2017 completed a booking, which is significantly higher than the 70% who did so in 2016. (Google, 2017)

- Online tours and attractions gross bookings will more than double from $9B in 2015 to $21B in 2020. And most of those online options will be mobile-optimized. (Phocuswright, 2017).

5. Online booking channels are most important to tour & activity operators

- Most tour operators have a distribution network that’s balanced 60% in favour of online channels. (TrekkSoft, 2016)

- Direct bookings on a supplier’s own website are ranked as most important to tour and activity operators. This is closely followed by incoming tour operators, direct offline bookings, and online resellers (OTAs and tour & activity marketplaces). (TrekkSoft, 2016)

- 61% of suppliers in this study claim they will have a mobile site with live booking by the end of this year. (Phocuswright, 2017).

Online travel agents (OTAs)

- Viator and Expedia Local Expert are the two most commonly used online travel agents in both Phocuswright's findings and TrekkSoft's distribution research report in Autumn 2016.

Offline

- Offline sales are still important. 45% of tour and attraction transactions are happening directly offline. This makes in-person exchanges a top channel for activity sales (Phocuswright, 2017).

Our take: A tourism business needs multiple sources of bookings to thrive and remain sustainable. Create a balanced distribution network with several strong booking sources to avoid the pressure if external factors suddenly work against your favour (which, in tourism, they often will).

There's no doubt about it: online is the future of the tours and attractions industry. You could be missing out on sales, partnerships, and those valuable last-minute bookings. Is your business ready to receive customers any time before your tours and activities?

6. Most travel bookings are done by women

- Women are the ones booking tours and activities 67% of the time (TrekkSoft data, 2017)

Key takeaways: The numbers have shown for some time that women are researching and booking the majority of holidays. Our data shows that also applies to tour and activity bookings.

7. Younger generations most likely to book online

- 75% of end users who book a tour or activity via TrekkSoft are aged 34 or younger. Of that percentage, 41% are aged 25-34 and 34% aged 18-24. (TrekkSoft data, 2017)

- 12% of people who book a tour or activity via TrekkSoft booking systems are aged 35-44. The smallest proportion of bookings are from older generations - just 6% of our bookings come from customers aged 45-54, and another 6% are aged 55 and above. (TrekkSoft data, 2017)

8. Activities is the third largest sector of travel

- Activities is the third largest segment of travel at $129B and is growing faster than the total travel market. It will reach $174B globally by 2020 (Phocuswright, 2017).

- Online tours and attraction gross bookings will more than double from $9 billion in 2015 to $21 billion in 2020. And suppliers need to be ready: online and on mobile. (Phocuswright, 2017).

- Since 2005, Phocuswright has noticed a huge influx of investment and innovation in travel activities. This includes more than 90 online resellers, 42 P2P marketplaces, and over 20 B2B reservation software startups. (Phocuswright, 2017).

9. But is the activities industry still stuck in the Stone Age?

- Tours and activities still have to emerge from the Stone Age. Phocuswright shares how 55% of tour and activity suppliers do not have a third-party reservation system, and of those who don’t, 67% use email or calendar to manage their bookings. (Phocuswright, 2017).

- Tour and activity suppliers cite "growing online sales" as their number one priority, and 3/4 say they will have live online booking before the end of 2017. (Phocuswright, 2017).

- Most suppliers are manually validating reservations, which is a risk as well as tedious. The larger suppliers ($1m+ revenue) are being hit hardest by fraud, among which 38% reconcile later. Geographically, emerging markets are worse off. (Phocuswright, 2017).

Our take: Suppliers need to see the urgency of investing in tech and working with online resellers, even if they think "we're doing just fine without it". This is especially the case for smaller suppliers and those in emerging markets. Consumer behaviour has shifted online (and increasingly last-minute and in-destination when booking), and suppliers have to be fighting against inertia and "how we've always done it". Tech is the enabler here.

10. Sustainable organisations are reaping the benefits

- Booking.com found that only 42 percent of those questioned considered themselves to be sustainable travellers. This number increased from last year among travellers from Italy, Germany, and China, but Australia, Brazil, Japan and the US have seen a decline. (Booking.com, 2017).

- According to the U.N.W.T.O., sustainable tourism has three guiding principles for hotels, tour operators, airlines and cruises (as well as destinations and tourists):

1) Make optimal use of environmental resources that constitute a key element in tourism development, maintaining essential ecological processes and helping to conserve natural heritage and biodiversity.

2) Respect the socio-cultural authenticity of host communities, conserve their built and living cultural heritage and traditional values, and contribute to inter-cultural understanding and tolerance

3) Ensure viable, long-term economic operations, providing socio-economic benefits to all stakeholders that are fairly distributed, including stable employment and income-earning opportunities and social services to host communities, and contributing to poverty alleviation.

- Eco-friendly tours are increasing. Intrepid Travel, for example, now offers more than 1,000 group tours a year that are fully carbon neutral. (NY Times, 2017)

- Booking.com predicted that the number of travellers staying in an eco-friendly or ‘green’ accommodation at least once could double in 2017. (Booking.com, 2017)

Key takeaways: In terms of setting goals for 2018, making your tourism business more sustainable is a great choice. While we should all be doing our bit for the planet, it also makes business sense. Now is the ideal time to solidify your reputation as a conscious organisation and set yourself apart from local competitors.

11. Trending destinations and brands aren't always predictable

- Emirates was chosen as the top airline worldwide for 2017 by TripAdvisor users in the platform's Travelers' Choice Awards (TripAdvisor, 2017)

- Top destinations on the rise are San Jose del Cabo (Mexico), Whistler (British Columbia), and Jericoacoara (Brazil) (TripAdvisor, 2017)

- The top landmarks in the world according to TripAdvisor users are Angkor Wat in Cambodia followed by Sheikh Zayed Grand Mosque Center in Abu Dhabi (TripAdvisor, 2017)

- Airbnb ranked as the most visited accommodation website in Q4 2016, receiving nearly 88 million visits, up 42% from Q4 2015. Booking.com came in second, with more than 82 million visits and a 24% growth rate, while Expedia-owned Hotels.com was fourth, with more than 65 million visits, up 25% YoY. (CMO, 2017)

12. The Chinese market is changing

- The growth of the Chinese outbound market continues. Mastercard's Future of Outbound Travel report predicts an average growth of 8.5% each year between 2016 and 2021.

- Less shopping, more experiences. In ITB's World Travel Trends report, tourism expert Professor Zhang Guangrui says the "crazy" spending habits of Chinese travellers might slow down sooner than expected.

Key takeaways: The Chinese market is becoming more segmented with a lot of diversity in travel habits. We're beginning to see a clear distinction between first-timer travellers and matured travellers, and they're not necessarily looking for the same things. In any case, it's important not to stereotype Chinese travellers when advertising to this market – especially as their travel preferences are changing so fast.

Read next: Here's what's changing about Chinese travellers in 2017

Other markets: How to reach the growing Arabian travel market

13. The industry is still trying to understand millennials

- Staycations make up 43% of all trips taken by Millennial families, especially those who wish to reduce environmental impact or save for a larger trip in the future. Not all millennials want to travel to exotic destinations. (Skift, 2016)

- Millennials don't always want to book a trip on their own. In a survey by MMGY, 34% of Millennials were found to use a travel agent and they're more likely to turn to professional planners when the upcoming trip is more expensive.

14. Travellers are merging business and leisure

- In the U.S. 43% of business trips are “bleisure” (Expedia Media Solutions, 2016)

- Business trips to attend conferences/conventions are more likely to turn into bleisure trips than client meetings or team offsites. (Expedia Media Solutions, 2016)

- Business trips with 3+ days are 30% more likely to add leisure (Expedia Media Solutions, 2016)

- 84% of bleisure trips are spent in the same city or area as the business trip (Expedia Media Solutions, 2016)

- Path to booking is short (1-4 weeks), especially the inspiration and research stage (Expedia Media Solutions, 2016)

- Bleisure travellers visit OTA sites the most on mobile devices, closely followed by Events. (Expedia Media Solutions, 2016)

15. Destinations are becoming more digital, but they're not always finding it easy

- 56% of DMOs focus their program budget on digital - and a majority expect to focus on it more in 2017. (TrekkSoft, 2017)

- 73% of DMOs say a lot of effort is required to stay digitally-relevant. That increases to 76% for organisations in Europe. (TrekkSoft, 2017)

- Only 9% of DMOs believe they have “a cutting edge digital strategy”. 55% try their best to stay digitally relevant but struggle. (TrekkSoft, 2017)

- 65% of DMOs say they enable some form of bookings on their official website. (TrekkSoft, 2017)

- Just 15% of organisations in our study said activities are bookable as real-time inventory on their official website. 8% are planning to change this and enable real-time bookable inventory in 2017. (TrekkSoft, 2017)

Key takeaways: The tourism boards that we see driving results are using a digital-first strategy to build an emotional and inspirational brand instead of focusing the majority of their efforts on broadcasting information. Rather than informing visitors, they are engaging and inspiring them with a content- and experience-rich approach online.

16. Experiences is still our favourite word in travel

- In a 2014 paper called Waiting for Merlot, psychologists Amit Kumar, Thomas Gilovich and Matthew Killingsworth show how experiential purchases (money spent on doing) tend to provide more enduring happiness than material purchases (money spent on having). Yet there are also differencesbefore consumption. People report being mostly frustrated before the planned purchase of a thing, but mostly happy before they bought an experience – such as a trip or an activity.

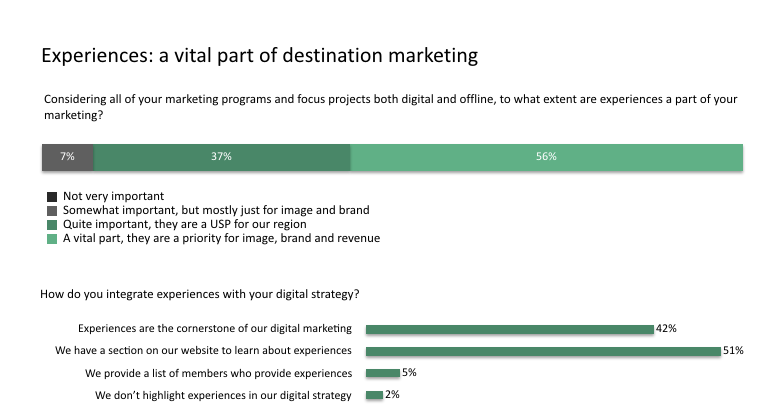

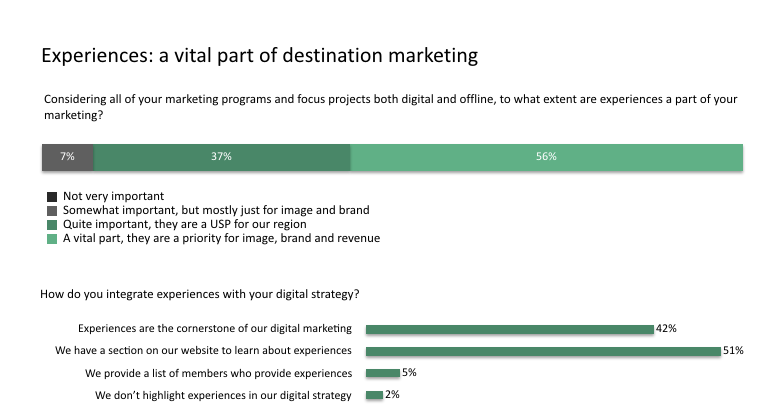

- 56% of DMOs consider experiences to be “a vital part” of their destination marketing. Only 7% consider experiences to be “somewhat important”. (TrekkSoft Destination Report, 2017)

- The most forward-thinking DMOs use a digital and content-first strategy to build an emotional & inspirational brand with experiences at its centre. (TrekkSoft, 2017)

- 73% of destination budgets are spent on marketing experiences, yet these are rarely online as real-time inventory. (TrekkSoft, 2017)

Key takeaways: We're in an experience economy. As the Guardian neatly sums up, "there is science behind it, but it’s also very simple: regardless of political uncertainty, austerity and inflation, we are spending more on doing stuff, choosing instead to cut back on buying stuff".

Travel brands can make inspiration the centre of their marketing and get consumers even more excited about their upcoming experience. With a positive guest experience, they can also encourage feedback, sharing, and word of mouth marketing.

17. Social media is still dominated by a few giants

- 72% of adult internet users use Facebook (Pew Research Center, 2015). The platform now has over 2 billion monthly users, compared to Twitter's 328M.

- Instagram has over 400M daily active users and 700M monthly active users. More than 250M stories are shared every day (Instagram, 2017).

- Beyond YouTube (with 1.5bn users), only Facebook’s other apps have more than 1 billion users, including WhatsApp and Facebook Messenger, with 1.2 billion each.

Read next:

18. Tourism companies need to consciously manage their reputation

- It's all about the guest experience. Leaders in customer experience reach an average of 17% on revenue growth within 5 years, whereas poorer customer experience attain only 3% over the same period (Forrester Research, 2016)

- 9 out of 10 travellers think that reading online reviews is important, but 45% of tour takers don't trust reviews on tour operators' own sites. Most important are reviews by third parties: 95% of travellers trust tour & activity reviews on third party sites (Stride Travel, 2016).

- 76% of travellers will pay more for a hotel if it has better online reviews (TrustYou, 2015).

Key takeaways: As we recently said to GuestRevu, the online reputation management platform, one of the things that can distinguish the best tour and activity companies from the competition is not just to provide a great tour, but to encourage guest feedback and use those insights to keep improving their offering.

Stay on top of your guest feedback, reviews, and online reputation and you'll be in the best position to help word of mouth spread about your business.

Read next:

19. Good marketing has visuals, creativity and a digital focus

- Articles with an image once every 75-100 words got double the number of social shares than articles with fewer images. (Buzzsumo, 2015)

- 84% of millennials don’t trust traditional advertising. Brands need to get creative instead of being pushy and disingenuous (The McCarthy Group, 2014).

- Mobile’s share of total digital ad spending in the travel industry (49% vs 51% for desktop ads) is creeping ever higher and in the future will represent a majority of the industry’s ad spending. (USDM)

- 69% of travelers are more loyal to a travel company that personalizes their experiences online and offline. (Google, 2017)

- 1/3 of DMOs cite content-centricity as the main way their organisation has changed since 2015. (TrekkSoft, 2017)

No comments:

Post a Comment